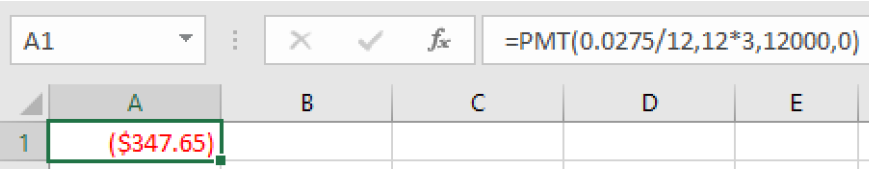

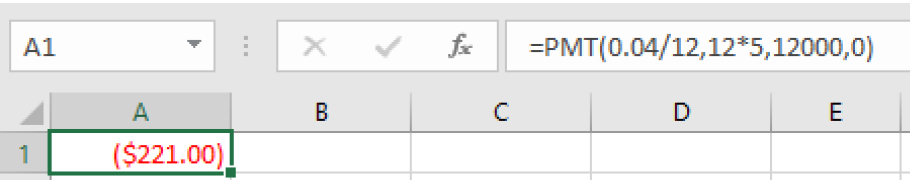

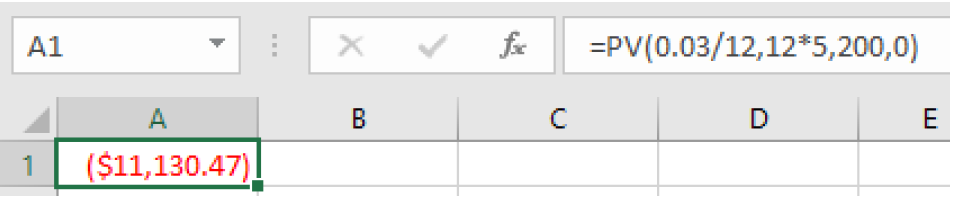

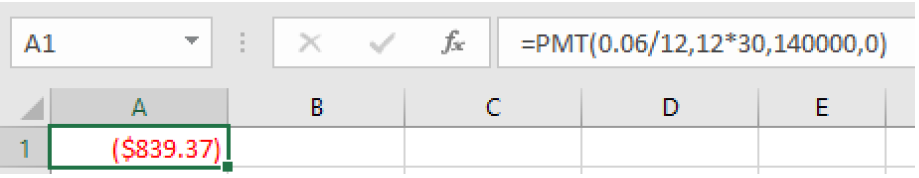

To use a spreadsheet for this problem, we use the

=PMT formula because we want to know the payment amount. The amount of the loan is the present value and to pay off the loan the future value is 0. We enter

=PMT(0.06/12, 12*30, 140000,0)

which gives us $839.37.

To use the formula, we have:

\(r=0.06\text{,}\) 6% annual rate

\(n=12\text{,}\) since we’re paying monthly

\(t=30\text{,}\) 30 years

\(P=\$140,000\text{,}\) the starting loan amount

In this case, we’re going to use the equation that is solved for

\(d\text{.}\)

\begin{align*}

d\amp=\frac{P\left(\frac{r}{n}\right)}{\left(1-\left(1+\frac{r}{n}\right)^{-nt}\right)}\\

\amp=\frac{140000\left(\frac{0.06}{12}\right)}{\left(1-\left(1+\frac{0.06}{12}\right)^{-12\cdot 30}\right)}\\

\amp=\frac{700}{(1-(1.005)^{-360})}\\

\amp\approx\$839.37

\end{align*}

You would make payments of $839.37 per month for 30 years. To find out what percentage of the total will go towards interest, we need to total up all of the payments.

\begin{equation*}

\$839.37(30)(12)=\$302,173.20

\end{equation*}

Then take the difference between the total payments and the loan amount.

\begin{equation*}

\$302,173.20-\$140,000=\$162,173.20

\end{equation*}

In this case, you would be paying $162,173.20 in interest over the life of the loan. To find the percentage, we divide the interest by the total amount paid.

\begin{equation*}

\frac{\$162,173.20}{\$302,173.20} \approx 0.5367

\end{equation*}

About 53.7% of the total is being paid towards interest.