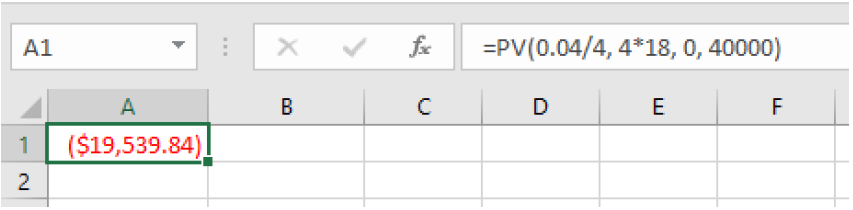

We are looking for what we need to deposit now so we will use the present value formula. We type the formula and inputs the same way we used the future value formula.

=PV(rate per period, number of periods, payment amount, future value)

=PV(0.04/4, 4*18, 0, 40000)

which gives a value of $19,539.84. You would need to deposit $19,539.84 now and keep the same interest rate to have $40,000 in 18 years.

Note that we cannot enter commas in numbers in a spreadsheet. Commas are used to separate the input values, so we would not get the same answer if we put in $40,000 for an input.

To use the mathematical formula, we use the one that is solved for

P.

\(r = 0.04\text{,}\) 4% APR

\(n = 4\text{,}\) 4 quarters in 1 year

\(t = 18\text{,}\) since we know the balance in 18 years

\(A = \$40,000\text{,}\) the amount we have in 18 years

In this case, we’re going to have to set up the equation, and solve for P.

\begin{align*}

P\amp=\frac{40000}{\left(1+\frac{0.04}{4}\right)^{4\cdot 18}}\\

\amp\approx19539.84

\end{align*}

You would need to deposit $19,539.84 now to have $40,000 in 18 years.