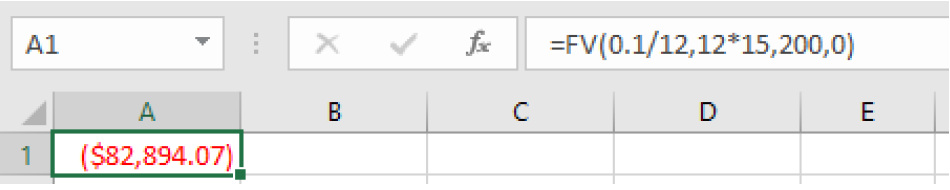

To use a spreadsheet, we will use

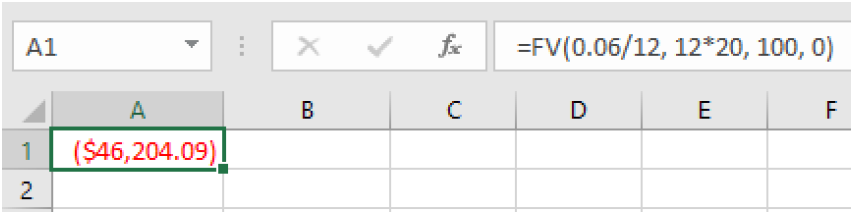

=FV because we want to know the balance in the future. We enter 100 for the payment amount and 0 for the present value:

=FV(0.06/12, 12*20, 100, 0)

which gives a result of $46,204.09.

Remember that the output of the formula gives the answer with the opposite sign as the principal and payments. For our purposes we will ignore the signs. To use the formula, we use the one solved for

A, since we want to know the final amount.

\(d=\$100\text{,}\) the monthly deposit

\(r=0.06\text{,}\) 6% annual rate

\(n=12\text{,}\) since we’re doing monthly deposits, we’ll compound monthly

\(t=20\text{,}\) we want the amount after 20 years

Putting this into the equation we have:

\begin{align*}

A\amp=\frac{100\left(\left(1+\frac{0.06}{12}\right)^{12\cdot 20}-1\right)}{\left(\frac{0.06}{12}\right)}\\

\amp=\frac{100\left((1.005)^{240}-1\right)}{(0.005)}\\

\amp\approx \$46.204.09

\end{align*}

With U.S. dollars we round to the nearest cent. The account will grow to $46,204.09 after 20 years.

To find the

amount of interest earned, calculate the total of all your deposits.

\begin{equation*}

\$100(20)(12)=\$24,000

\end{equation*}

The difference between the total amount and the deposits is the interest earned.

\begin{equation*}

\$46,204.09-\$24,000=\$22,204.09

\end{equation*}

The total amount of interest you earned was $22,204.09.

To find the

percentage of the balance that is interest we will divide the interest by the total balance.

\begin{equation*}

\frac{\$22,204.09}{\$46,204.09}\approx 0.4810

\end{equation*}

or 48.1%. After 20 years 48.1% of the balance is from interest.