Worksheet 2.2.1 Credit Crunch Worksheet

Objectives

Demonstrate operation sense by communicating in words and symbols the effects of operations on numbers. Apply the correct order of operations in evaluating expressions and formulas.

Apply quantitative reasoning strategies to solve real-world problems with proportional relationships using whole numbers, fractions, decimals, and percents as appropriate.

1.

According to the Federal Reserve System the total credit card debt carried by Americans as of March 2015 was 848.1 billion dollars. Write this number in standard notation in dollars and also in scientific notation.You will use the following information from a credit card disclosure in the next few questions.

Annual Percentage Rate (APR) for Purchases

0.00% introductory APR for 6 months from the date of account opening. After that, your APR will be 10.99% to 23.99% based on your creditworthiness. This APR will vary with the market based on the Prime Rate.

2.

APR stands for Annual Percentage Rate. It is the total interest rate for the entire year. However, we normally make a credit card payment each month. The amount of interest paid each month is called the Periodic Rate. Find the monthly Periodic Rate for an APR of 10.99%, rounded to two decimal places.Creditworthiness is measured by a “credit score,” with a high credit score indicating good credit. In the following questions, you will explore how your credit score can affect how much you have to pay in order to borrow money. Juanita and Brian both have a credit card with the terms in the disclosure form given above. They have both had their credit cards for more than 6 months.

3.

Juanita has good credit and gets the lowest interest rate possible for this card. She is not able to pay off her balance each month, so she pays interest. Estimate how much interest Juanita would pay in the month of January if her unpaid balance is $5000. She has already owned the card for more than six months.4.

If Juanita maintains an average balance of $5000 every month for a year, estimate how much interest she will pay in a year.5.

Brian has a very low credit score and has to pay the highest interest rate. He is not able to pay off his balance each month, so he pays interest. Calculate how much interest he would pay in the month of January if his balance is $5000, to the nearest cent.6.

If Brian maintains an average balance of $5000 every month for a year, calculate how much interest he will pay in a year.You will use the following information from the disclosure for the next question. A cash advance is when you use your credit card to get cash instead of using it to make a purchase.

Annual Percentage Rate (APR) for Purchases |

APR for Cash Advances |

|---|---|

After that, your APR will be 10.99% to 23.99% based on your creditworthiness. This APR will vary with the market based on the Prime Rate. |

28.99%. This APR will vary with the market based on the Prime Rate. |

7.

Determine how to fill in the blank to create a reasonable statement.Jeff pays the highest interest rate for purchases. Over a year, for a cash advance he would pay $ more interest for each dollar he charges to his card, compared to using it for a purchase.

8.

Determine how to fill in the blank to create a reasonable statement.Lois pays the lowest interest rate for purchases. If she purchased a $400 TV using a cash advance, she would pay about times as much interest as she would if she used the card as a regular purchase.

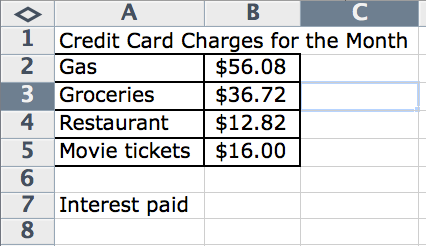

Brian used a spreadsheet to record his credit card charges for a month. In a spreadsheet, you can refer to a "cell" (one of the boxes that hold numbers or words) using it's location. For example, $56.08 is in column B and row 2, so we say it is in cell B2.

Brian entered the following formula in cell B7 to calculate his interest for these charges for one month.

= (0.2399/12) * (B2 + B3 + B4 + B5)

9.

Which of the following statements best explains what the expression means in terms of the context?Brian found the interest charge for the month by dividing 0.2399 by 12 and multiplying it by the sum of Column B.

Brian added his individual charges. Then he divided 0.2399 by 12. Then he multiplied the two numbers.

Brian found the periodic rate by dividing his APR of 0.2399 by 12 months. He then added the individual charges to get the total amount charged to the credit card. He multiplied the periodic rate by the total charges to find the interest charge for the month.

10.

Which of the following are other ways that Brian could have done the calculation (there may be more than one correct answer)= B2 + B3 + B4 + B5 * 0.2399 / 12

= (1/12)*0.2399*(B2 + B3 + B4 + B5)

= B2*0.2399/12 + B3*0.2399/12 + B4*0.2399/12 + B5*0.2399/12

= (B2 + B3 + B4 + B5)*0.2399/12

= (0.2399*(B2 + B3 + B4 + B5))/12

= (0.2399/12)*B2 + B3 + B4 + B5