Worksheet Income Taxes

Objectives

Demonstrate operation sense by communicating in words and symbols the effects of operations on numbers. Apply the correct order of operations in evaluating expressions and formulas.

Apply quantitative reasoning strategies to solve real-world problems with proportional relationships using whole numbers, fractions, decimals, and percents as appropriate.

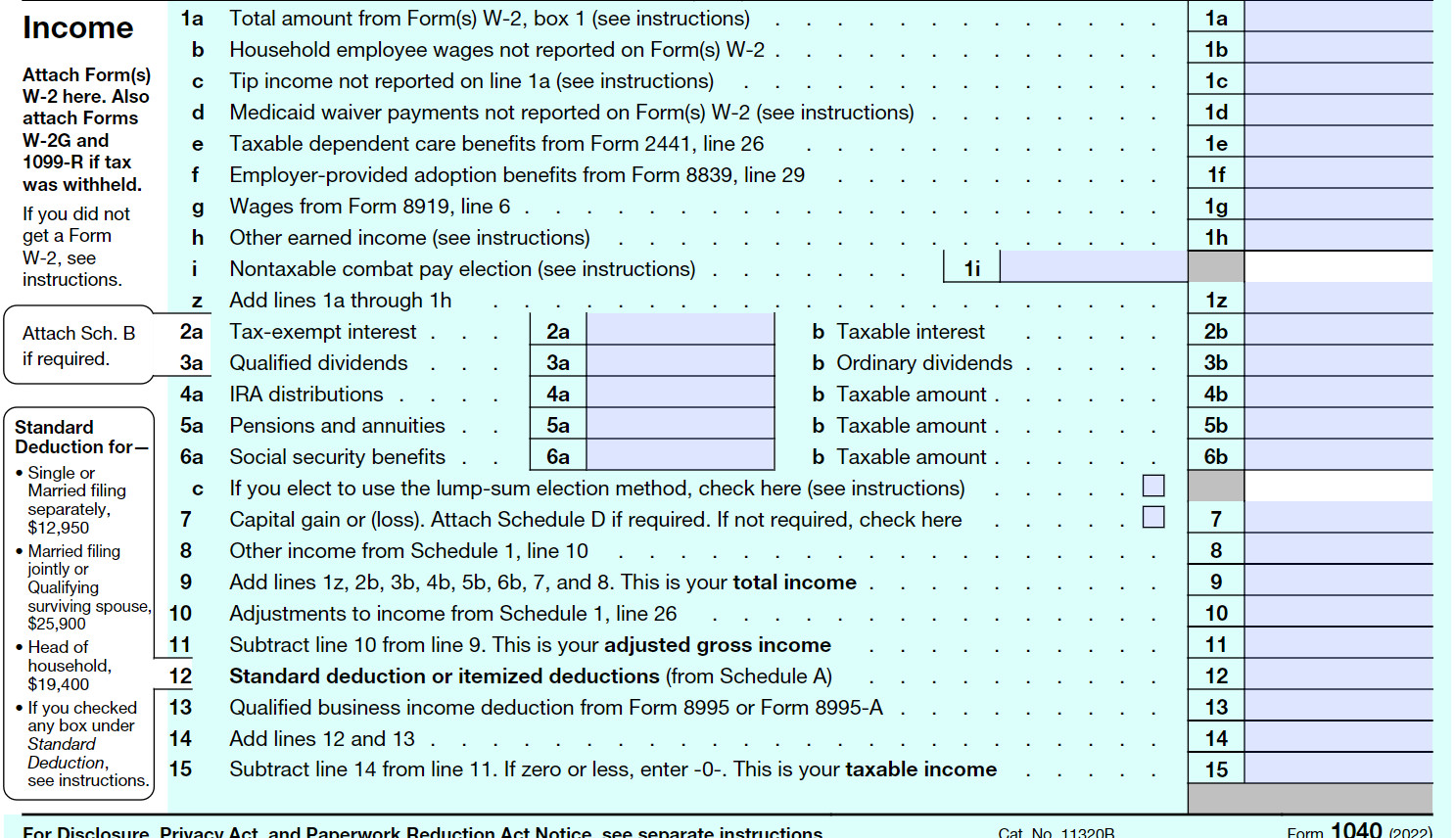

In the United States, people pay income tax on any income they earn during the year. The total amount of money they earn through work, investments, and other means is called total income. From this, people are able to deduct certain things, like retirement contributions and tuition payments, reducing their income to what is called their adjusted gross income. From this, certain expenses can be deducted resulting in the taxable income that tax is actually calculated on.

Taxes can be, as you've probably heard, fairly complicated, but for this lesson we are going to focus on a simple case: a couple we'll name Gracie and Lancel.

Gracie and Lancel are married with no kids, filing jointly. No one can claim either as a dependent.

Together, they earned $106,900 of wage income

They did not earn anything from interest, dividends, distributions, annuities, benefits, capital gains, or anything else.

They plan to take the standard deduction.

They contributed more than $600 to their church (According to instructions from the IRS, for a couple filing jointly who take the standard deduction, the maximum amount they can claim is $600).

They had no qualified business income

They can claim $2250 in adjustments to income because Gracie is an elementary teacher who can mark $250 for educator expenses and they can claim $2000 because of their payments toward the interest of their student loans.

1.

Fill out boxes 1-15 the form to find the couple's taxable income

2.

Usually tax owed is looked up from a tax table. You would use the first line of the table if the taxable income from line 6 is at least 72,000 but less than 72,050.Write this as a compound inequality, using t to represent the income from line 6.

Then use the table provided to determine the tax the couple owes.

Alternatively, the couple could calculate the tax based on tax rate information. A portion of the rate table from 2022 is shown.

| If taxable income is: | The tax is: |

|---|---|

| $0 to $20,550. | 10% of taxable income. |

| $20,551 to $83,550. | $2,055 plus 12% of the amount over $20,550. |

| $83,551 to $178,150. | $9,615 plus 22% of the amount over $83,550. |

| $178,151 to $340,100. | $30,427 plus 24% of the amount over $178,150. |

| $340,101 to $431,900. | $69,295 plus 32% of the amount over $340,100. |

| $431,901 to $647,850. | $98,671 plus 35% of the amount over $431,900. |

| $647,851 or more. | $174,253.50 plus 37% of the amount over $647,850. |

The rates you see on the right (10%, 12%, 22%, 24%, 32%, 35%, 37%) are called marginal tax rates, but most people just call them tax brackets.

3.

Use the tax rates above to calculate the couple's tax. Does it match the tax table?4.

A commonly held belief is that marginal tax rate applies to all of a person's taxable income. What is 12% of their taxable income, and how does this compare to actual income tax?5.

What percent of their taxable income are they paying? This is called the effective or average tax rate. Round your answer to a tenth of a percentage point.Sometimes people have been hesitant to accept raises, worried that it will push them into a new tax bracket and they'll end up losing money.

6.

Suppose the couple got an unexpected $6,000 bonus at the end of the year, pushing them into the 22% marginal rate tax bracket. How much tax will they pay?7.

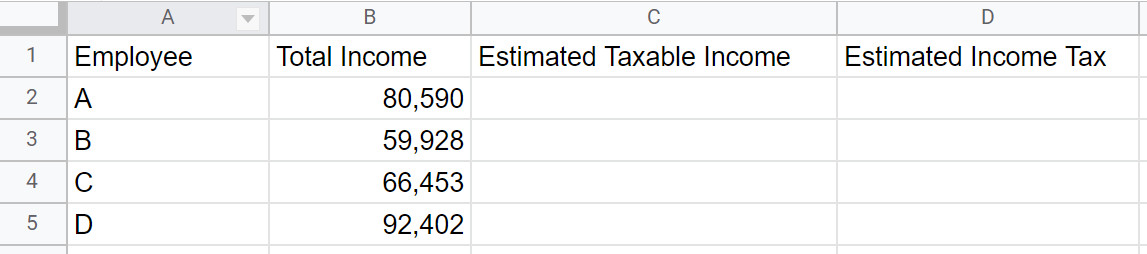

What is the difference between their take-home pay with and without the bonus? Will the couple end up with less take-home pay because the bonus pushed them into a higher tax bracket?While tax tables and the tax rates work well for calculating tax for a single individual, a business might want to create a spreadsheet that automatically calculates the tax for their employees.

For simplicity, let's assume all of the employees are married and filing jointly, and all of their taxable incomes fall between $20,551 and $83,550. Let's also assume that they will take the standard deduction, have no other income, make no adjustments to their taxable income, and give nothing to charity. These assumptions will be close enough for this company's purposes.